XRP Surges 17% After Ripple-SEC Case Ends

XRP jumped 17% on Wednesday, beating gains in other major cryptocurrencies, after a U.S. judge ruled in favor of Ripple Labs in a long-running case with the Securities and Exchange Commission (SEC).

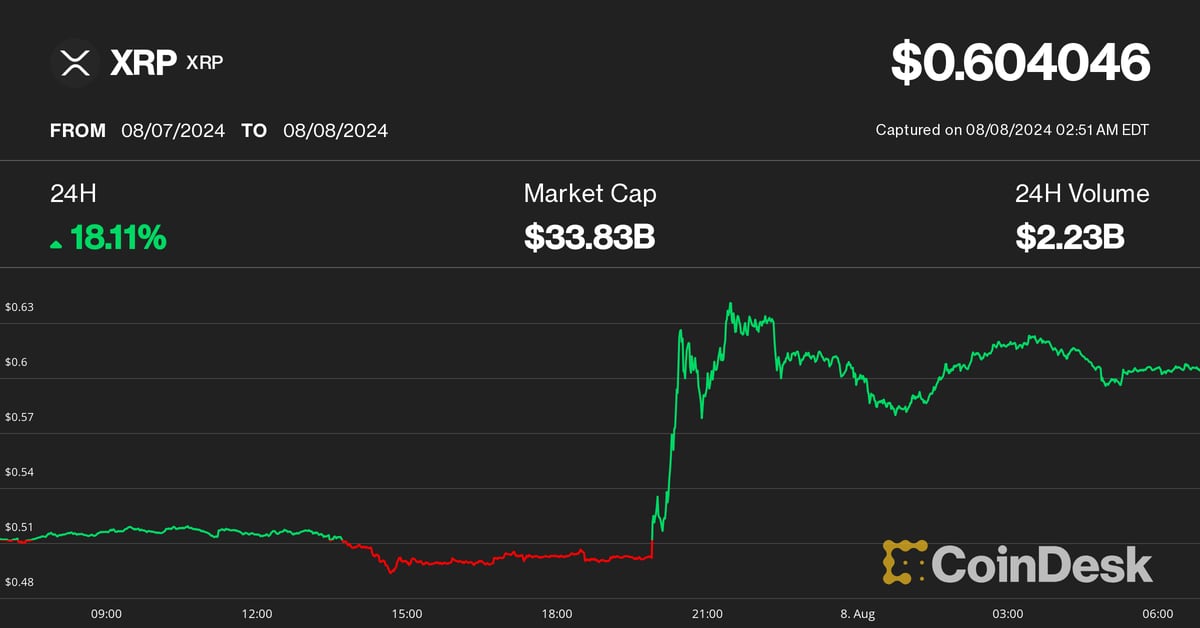

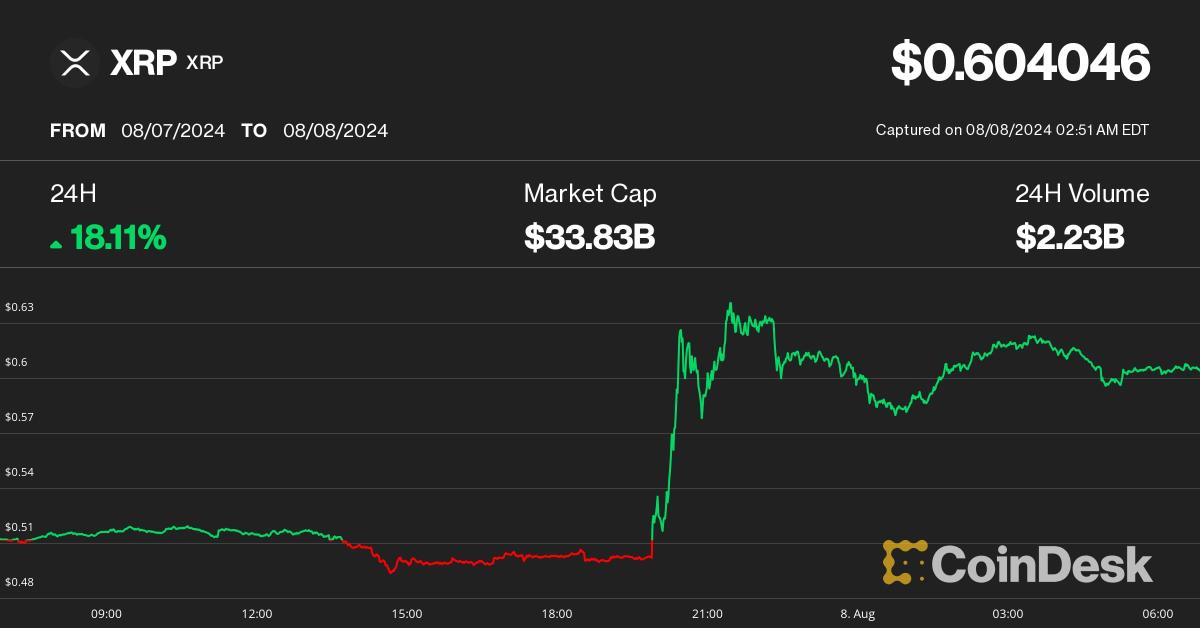

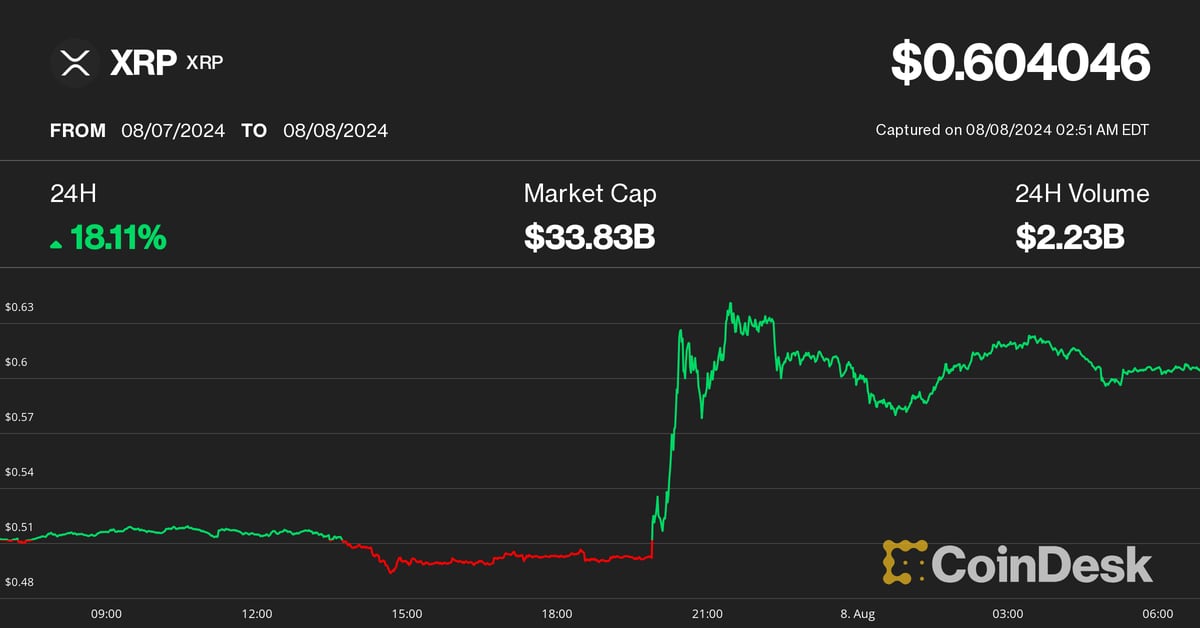

Market Reaction

The price of XRP surged to 65 cents from 50 cents after the ruling, with trading volumes jumping to $4.2 billion in the past 24 hours from Tuesday’s $1.2 billion. The sudden increase in price and trading activity suggests that the market is optimistic about the ruling and its implications for XRP and the broader cryptocurrency industry.

Impact on Trading Activity

As a result of the ruling, there were just $6 million in short liquidations on XRP-tracked futures, suggesting that the movements were spot-driven. Meanwhile, open interest on XRP-tracked futures rose by $200 million in the wake of the ruling, indicative of new money entering the market. Data shows that over 60% of these traders have a long bias and expect prices to increase further.

Implications for Ripple and the SEC

The ruling has significant implications for Ripple and the SEC, as it brings an end to the long-running case. While the SEC is expected to appeal the ruling, the judge’s decision is a major victory for Ripple and could have far-reaching implications for the cryptocurrency industry. The ruling could pave the way for other cryptocurrencies to be classified as commodities rather than securities, which could lead to greater regulatory clarity and potentially more mainstream adoption.

Trading Volumes Jump as Market Reacts to Ruling

Trading volumes for XRP surged to $4.2 billion in the past 24 hours, a significant increase from Tuesday’s $1.2 billion. This jump in trading activity is a clear indication that the market is reacting positively to the ruling in favor of Ripple Labs.

Spot-Driven Movements

The sudden increase in price and trading activity suggests that the movements were spot-driven, rather than driven by futures contracts. This is supported by data showing just $6 million in short liquidations on XRP-tracked futures, indicating that the market is optimistic about the future prospects of XRP.

New Money Enters the Market

The open interest on XRP-tracked futures rose by $200 million in the wake of the ruling, indicating that new money is entering the market. This influx of new capital is a positive sign for XRP and suggests that the market is confident in the future prospects of the cryptocurrency.

Trader Sentiment

Data shows that over 60% of traders with open positions on XRP-tracked futures have a long bias, expecting prices to increase further. This sentiment is reflected in the surge in price and trading activity, as traders are betting on the future success of XRP.

Market Sentiment Index

The market sentiment index for XRP is currently bullish, with many traders expecting the price to continue to rise in the coming days and weeks. This optimism is driven by the positive ruling and the potential implications for the cryptocurrency industry as a whole.

Ripple to Pay $125 Million in Civil Penalties

Ripple Labs has been ordered to pay $125 million in civil penalties as part of the settlement in the long-running case with the Securities and Exchange Commission (SEC). This is a significant development in the case, which has been ongoing for several years.

Court Ruling

The court ruling in favor of Ripple Labs is a major victory for the company, which has been fighting the SEC’s charges since 2020. The SEC had alleged that XRP was a security and therefore subject to regulation, while Ripple argued that it was a commodity and not a security.

Civil Penalties

The $125 million in civil penalties is a significant amount, but it is a fraction of the $1.3 billion that the SEC had initially sought. The penalties are a result of Ripple’s failure to register XRP as a security, which the SEC argued was a requirement under the Securities Act of 1933.

Injunction Against Future Securities Law Violations

In addition to the civil penalties, the court also imposed an injunction against Ripple, preventing the company from engaging in future securities law violations. This is a significant development, as it ensures that Ripple will not be able to engage in similar activities in the future.

Impact on Ripple and XRP

The settlement is a major victory for Ripple, which can now move forward without the weight of the SEC’s charges hanging over its head. The settlement is also a positive development for XRP, which has seen its price surge in response to the news. The settlement is expected to have a positive impact on the cryptocurrency industry as a whole, as it sets a precedent for how securities law will be applied to digital assets.

SEC Expected to Appeal, Extending Legal Proceedings

The Securities and Exchange Commission (SEC) is expected to appeal the court’s ruling in favor of Ripple Labs, extending the legal proceedings in the case. This is a not unexpected development, as the SEC had previously stated its intention to appeal the decision.

Appeal Process

The appeal process is likely to be lengthy and complex, with both sides presenting their arguments in front of a higher court. The SEC will likely argue that the lower court’s decision was incorrect and that XRP should be classified as a security, while Ripple will argue that the lower court’s decision was correct and that XRP is a commodity.

Potential Outcomes

There are several potential outcomes of the appeal process, including the possibility that the higher court could uphold the lower court’s decision, or that it could reverse the decision and rule in favor of the SEC. Alternatively, the higher court could send the case back to the lower court for further consideration.

Impact on Ripple and XRP

The appeal process is likely to have a significant impact on Ripple and XRP, as it could delay the resolution of the case and create further uncertainty for investors. However, the company has stated that it is confident in its position and is prepared to continue fighting the SEC’s charges.

Market Reaction

The market reaction to the news of the appeal is likely to be significant, with the price of XRP potentially fluctuating in response to the development. Investors are advised to exercise caution and to monitor the situation closely as it develops.

XRP Outperforms Bitcoin, Other Cryptocurrencies

XRP has outperformed Bitcoin and other major cryptocurrencies in the wake of the court’s ruling in favor of Ripple Labs. The price of XRP has surged to 65 cents from 50 cents, while Bitcoin and other major cryptocurrencies have remained relatively flat.

XRP’s Gains

XRP’s gains are a significant development, as the cryptocurrency has struggled to gain traction in recent months. The court’s ruling has provided a much-needed boost to the cryptocurrency, and it is likely to continue to outperform in the short term.

Bitcoin’s Lack of Movement

Bitcoin’s lack of movement is a notable development, as the cryptocurrency is typically seen as a bellwether for the wider cryptocurrency market. The fact that Bitcoin is not reacting to the news suggests that the market is still digesting the implications of the court’s ruling.

Other Cryptocurrencies

Other cryptocurrencies, such as Ethereum and Litecoin, have also failed to react significantly to the news. This is likely due to the fact that the court’s ruling is specific to Ripple and XRP, and does not have a direct impact on these other cryptocurrencies.

Market Implications

The market implications of the court’s ruling are significant, as it sets a precedent for how securities law will be applied to digital assets. The ruling is likely to have a positive impact on the wider cryptocurrency market, as it provides clarity and certainty for investors and businesses operating in the space.

Market Implications of the Ripple-SEC Case Ruling

The market implications of the Ripple-SEC case ruling are significant, as it sets a precedent for how securities law will be applied to digital assets. The ruling is likely to have a positive impact on the wider cryptocurrency market, as it provides clarity and certainty for investors and businesses operating in the space.

Regulatory Clarity

The ruling provides regulatory clarity for digital assets, as it establishes that XRP is a commodity and not a security. This is a significant development, as it reduces the regulatory burden on companies operating in the space and provides a clear framework for how digital assets should be treated.

Increased Adoption

The ruling is likely to lead to increased adoption of digital assets, as it provides a clear and favorable regulatory environment. This is likely to attract new investors and businesses to the space, which will drive growth and development.

Impact on Other Cryptocurrencies

The ruling is likely to have a positive impact on other cryptocurrencies, as it sets a precedent for how securities law will be applied to digital assets. This is likely to lead to increased adoption and investment in the space, as it provides clarity and certainty for investors and businesses.

Long-Term Implications

The long-term implications of the ruling are significant, as it establishes a clear and favorable regulatory environment for digital assets. This is likely to drive growth and development in the space, and provide new opportunities for investors and businesses.

Conclusion

In conclusion, the market implications of the Ripple-SEC case ruling are significant, as it sets a precedent for how securities law will be applied to digital assets. The ruling is likely to have a positive impact on the wider cryptocurrency market, and provide clarity and certainty for investors and businesses operating in the space.